Chase Freedom Flex vs. Freedom Unlimited: Which Card Best Supports Your Sapphire? A Full Review & Strategy Guide

You love your Chase Sapphire Preferred or Chase Sapphire Reserve card for its travel perks and powerful Ultimate Rewards points. But to truly supercharge your earnings, especially on everyday purchases, pairing it with one of Chase's no-annual-fee Freedom cards can significantly enhance your rewards. These cards turn everyday spending into valuable points that can be significantly boosted when combined with your Sapphire account.

This post provides a full review of both the Chase Freedom Flex and the Chase Freedom Unlimited, detailing all their benefits, perks, and earning structures. We'll then explore how they work with your Sapphire card and help you decide which one (or potentially both!) is the right fit for your wallet.

Deep Dive: Chase Freedom Flex Review

The Freedom Flex is known for its rotating bonus categories and unique Mastercard perks.

Earning Rewards:

5% Cash Back (5x points): On up to $1,500 in combined purchases in rotating quarterly bonus categories (activation required each quarter).

Q2 2025 Categories (April 1 - June 30): Amazon purchases and Select Streaming Services.

Note: Past categories frequently include gas stations, grocery stores, PayPal, wholesale clubs, etc.

5% Cash Back (5x points): On travel purchased through Chase Travel.

3% Cash Back (3x points): On dining at restaurants (includes takeout and eligible delivery services).

3% Cash Back (3x points): On drugstore purchases.

1% Cash Back (1x points): On all other purchases.

Welcome Offer & Annual Fee:

Bonus: Earn a $200 Bonus (issued as 20,000 Ultimate Rewards® points) after spending $500 on purchases in your first 3 months from account opening.

Annual Fee: $0

Intro APR Offer:

Purchases: 0% intro APR for 15 months from account opening.

Balance Transfers: 0% intro APR for 15 months from account opening (transfers must be made within 60 days of account opening).

Balance Transfer Fee: Either $5 or 5% of the amount of each transfer, whichever is greater.

Regular APR: After the intro period, a variable APR of 18.99%–28.49% applies.

Redemption Options:

Points are earned as Ultimate Rewards.

Without a Sapphire card: Redeem points for cash back (statement credit or direct deposit), gift cards, travel through Chase Travel, or Pay Yourself Back categories (when available), typically at a value of 1 cent per point. You can also use points to shop at Amazon or via PayPal, often at a lower value.

With a Sapphire card: Combine points with your Sapphire Preferred or Reserve account for enhanced redemption value (see "The Sapphire Connection" below).

Benefits & Perks:

Travel Protections:

Trip Cancellation/Interruption Insurance: Reimburses pre-paid, non-refundable passenger fares up to $1,500 per person and $6,000 per trip if cut short or canceled due to covered situations like sickness or severe weather.

Auto Rental Collision Damage Waiver (CDW): Provides secondary coverage (primary outside the U.S.) against theft and collision damage for most rental cars when you decline the rental company's insurance and charge the entire rental cost to your card.

Travel and Emergency Assistance Services: Access to legal and medical referrals or other travel emergency assistance when away from home (you pay for the cost of services received).

Shopping Protections:

Purchase Protection: Covers new purchases against damage or theft for 120 days, up to $500 per claim and $50,000 per account.

Extended Warranty Protection: Extends the time period of eligible U.S. manufacturer's warranties (of three years or less) by an additional year.

Mastercard World Elite Benefits:

Cell Phone Protection: This is a standout perk. Get up to $800 per claim and $1,000 per year in protection against covered theft or damage for phones listed on your monthly bill when you pay that bill with your Flex card. A $50 deductible applies per claim, maximum of 2 claims per 12-month period.

Partner Benefits (Chase Specific):

DoorDash: Get a complimentary 3 months of DashPass (offering $0 delivery fees and reduced service fees on eligible orders). After the trial, you're automatically enrolled at 50% off for the next 9 months. Activation required. (Terms subject to change; verify current benefits directly with Chase).

Other Perks:

Zero Liability Protection: You aren't responsible for unauthorized charges.

Fraud Monitoring: 24/7 monitoring with alerts for unusual activity.

Chase Offers: Access targeted discounts at various merchants.

Chase Credit Journey: Free access to your credit score and monitoring tools.

Click Here to Apply for the Chase Freedom Flex

Deep Dive: Chase Freedom Unlimited Review

The Freedom Unlimited shines with its straightforward, elevated flat-rate earning on everyday spending.

Earning Rewards:

5% Cash Back (5x points): On travel purchased through Chase Travel.

3% Cash Back (3x points): On dining at restaurants (includes takeout and eligible delivery services).

3% Cash Back (3x points): On drugstore purchases.

1.5% Cash Back (1.5x points): On all other purchases. (This is the key differentiator from Flex).

There are NO rotating categories that offer 5x points on this card

Welcome Offer & Annual Fee:

Bonus: Limited Time Offer: Earn a $250 Bonus (issued as 25,000 Ultimate Rewards® points) after spending $500 on purchases in your first 3 months from account opening. (Currently better than the Flex offer - Ends May 1st 2025)

Annual Fee: $0

Intro APR Offer:

Purchases: 0% intro APR for 15 months from account opening.

Balance Transfers: 0% intro APR for 15 months from account opening (transfers must be made within 60 days of account opening).

Balance Transfer Fee: Either $5 or 5% of the amount of each transfer, whichever is greater.

Regular APR: After the intro period, a variable APR of 18.99%–28.49% applies.

Redemption Options:

Identical to the Chase Freedom Flex (see above). Points earned as Ultimate Rewards, redeemable at 1 cent per point for cash back/gift cards/basic portal travel, or combined with a Sapphire card for enhanced value.

Benefits & Perks:

Travel Protections:

Trip Cancellation/Interruption Insurance: Same coverage as Flex ($1,500/person, $6,000/trip).

Auto Rental Collision Damage Waiver (CDW): Same secondary coverage as Flex.

Travel and Emergency Assistance Services: Same referral service as Flex.

Shopping Protections:

Purchase Protection: Same coverage as Flex (120 days, $500/claim, $50k/account).

Extended Warranty Protection: Same coverage as Flex (1 extra year on eligible <3yr warranties).

Visa Benefits:

While lacking the specific Cell Phone Protection of the Flex, it comes with standard Visa benefits like Zero Liability protection.

Key Difference: As a Visa card, it is accepted at Costco warehouses in the U.S., whereas Mastercards (like the Flex) generally are not, unless shopping online.

Partner Benefits (Chase Specific):

DoorDash: Same offer as Flex (3 months free DashPass, then 9 months at 50% off). Activation required. (Verify current terms with Chase).

Other Perks:

Zero Liability Protection: Same as Flex.

Fraud Monitoring: Same as Flex.

Chase Offers: Same as Flex.

Chase Credit Journey: Same as Flex.

Click Here to Apply for the Chase Freedom Unlimited

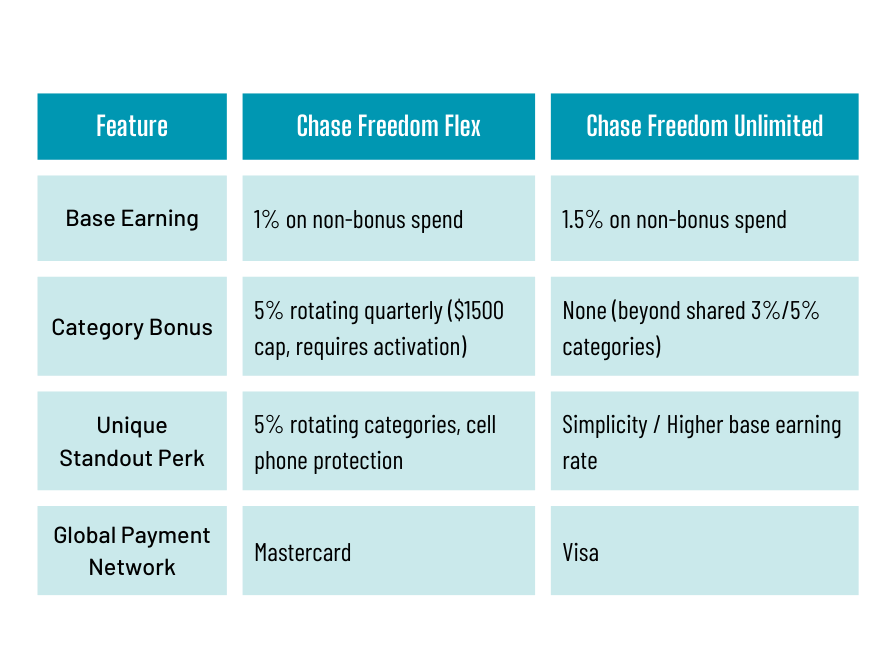

Head-to-Head Comparison: Flex vs. Unlimited

Here’s how the Freedom Flex and Freedom Unlimited stack up side by side across the features that matter most.

Shared Perks include no annual fee, 3% and 5% categories, Intro APR, and Travel/Shopping Protections.

The Sapphire Connection: Unlocking More Value

Here's where pairing either Freedom card with your Sapphire Preferred or Reserve truly shines:

Combine Points: Log in to your Chase Ultimate Rewards account online or via the app. Select "Combine Points" under Rewards Details or Manage Points. Choose your Freedom card as the source ("From") and your Sapphire card as the destination ("To"). The transfer is instant and free between your own accounts.

Increased Value: Once points are in your Sapphire account:

Chase Travel Portal: Redeem points for travel at 1.25 cents each (Sapphire Preferred) or 1.5 cents each(Sapphire Reserve). That turns the Freedom Unlimited's 1.5% base earning into an effective 1.875% or 2.25% return! The Flex's 5% categories become an effective 6.25% or 7.5% return.

Transfer Partners: Transfer points 1:1 to valuable airline and hotel partners (like World of Hyatt, Southwest Rapid Rewards, United MileagePlus, Air Canada Aeroplan. This often yields the highest potential value, sometimes well over 2 cents per point, especially for premium cabin flights or luxury hotel stays.

Real-Life Example #1: Grocery Shopping with Freedom Flex + Sapphire Preferred

Let’s say you have the Freedom Flex, and this quarter’s 5% category includes grocery stores. You spend $1,200 on groceries during the 3-month period.

You earn 6,000 points (5x on $1,200).

Move those 6,000 points to your Sapphire Preferred.

Book travel through Chase Travel → 6,000 x 1.25¢ = $75 in travel value.

That’s a 6.25% effective return on grocery shopping—far better than the standard 1%!

Want even more value? Transfer those 6,000 points to Hyatt and snag a free night at a Category 1 hotel (often worth $100–$150).

Real-Life Example #2: Daily Spending with Freedom Unlimited + Sapphire Reserve

Let’s say you use the Freedom Unlimited for all your random purchases—groceries, Amazon, kids' soccer gear, Target runs—and spend $2,000 in a month.

You earn 3,000 points (1.5x on $2,000).

Move those 3,000 points to your Sapphire Reserve.

Book travel through Chase Travel → 3,000 x 1.5¢ = $45 in travel value.

That’s a 2.25% return on otherwise unbonused spending.

If you transferred those points to United or Air Canada Aeroplan, you could even top $60–$75 in value depending on how you redeem.

Which Freedom Card is Right For You?

As a Standalone Card: Both are strong no-annual-fee contenders. The Unlimited offers easier, consistent value with its 1.5% base. The Flex has higher potential rewards if you maximize the 5% categories and value the cell phone protection.

As a Sapphire Companion:

Choose Freedom Flex if: You're a rewards optimizer who will diligently track and activate the 5% categories, your spending aligns well with those categories, and you highly value the cell phone protection.

Choose Freedom Unlimited if: You prioritize simplicity, want a higher guaranteed return on all your miscellaneous spending (making it an excellent "catch-all" card), don't want to track categories, or need a card for Costco. The currently higher welcome bonus is also appealing (subject to change, always check current bonus details when applying).

Maximize Points with Both: Chase Freedom Flex + Freedom Unlimited Strategy

For maximum point accumulation to fuel your Sapphire card, consider getting both the Freedom Flex and Freedom Unlimited.

Use the Flex for purchases in the active 5% rotating category (up to the $1500 quarterly cap).

Use either card for 5% on Chase Travel, 3% on dining, and 3% at drugstores.

Use the Unlimited for all other purchases to earn 1.5%.

Combine all points into your Sapphire account for maximum redemption value.

If you are worried about your 5/24 status and do not want to outright sign up for this card due to the low sign up bonus, I hear you. There are certainly many more cards that give much higher sign up bonuses compared to the freedom flex cards. Check out this next option below regarding another method to getting one of these cards.

Advanced Strategy: The Sapphire Downgrade & Re-Apply Path

For existing Sapphire Preferred or Reserve cardholders looking at the long game, there's a popular strategy involving product changing to a Freedom card. Here's why and how:

Step-by-Step Guide To Downgrading Your Sapphire to a Freedom Card and then Reapplying

If you've had your Sapphire card for a while and are past the 48-month mark since you last received the sign up bonus, you can potentially earn another one by following these steps:

Check Eligibility:

Have you held your current Sapphire card for at least 12 months? (Chase generally requires this before allowing a product change).

Has it been 48 months or more since the date your last Sapphire welcome bonus posted to your account?

Product Change (Downgrade): Call the number on the back of your Sapphire card and request to product change it to a Chase Freedom Flex or Chase Freedom Unlimited.

Timing Tip: Doing this within about 30 days after your Sapphire annual fee posts often results in a full refund of that fee.

Wait: Allow a short period (10 days for safety) for Chase's system to fully update and reflect that you no longer hold a Sapphire card.

Apply Anew: Submit a new application for the Chase Sapphire Preferred or Reserve.

Earn the Bonus: If approved (subject to Chase's criteria, including your 5/24 status and creditworthiness), meet the minimum spending requirement to earn the welcome bonus again.

Why Consider This?

Save a 5/24 Slot: Chase has an unwritten rule known as "5/24," meaning you generally won't be approved for most Chase cards if you've opened 5 or more new credit card accounts (from any bank) in the past 24 months. A product change (switching your existing card to another Chase card) does not count as a new account opening, preserving your precious 5/24 slots for future applications.

Become Eligible for a New Sapphire Bonus: Chase has a strict rule: You can only earn a welcome bonus on a Sapphire card (either Preferred or Reserve) if you do not currently hold any Sapphire card AND it has been at least 48 months since you last received a Sapphire welcome bonus.

This strategy removes the Sapphire card from your active accounts but keeps your credit line and account history intact, which is important for your credit score.

Important Considerations:

Lose Sapphire Benefits Immediately: The moment you downgrade, you lose all Sapphire-specific benefits like higher portal redemption rates, access to transfer partners, travel credits, lounge access (for Reserve), etc.

Point Value Changes: Your existing Ultimate Rewards points remain safe on the new Freedom card. However, without an active Sapphire (or Ink Business Preferred) card linked, those points cannot be transferred to airline/hotel partners and are only worth 1 cent each when redeemed for travel via the portal or for cash back. Plan accordingly – use or transfer points before downgrading if necessary, or wait until your new Sapphire card is approved and linked.

No Bonus on Product Change: You do not earn a welcome bonus when product changing. The bonus comes from the new application.

Rules Can Change: Chase policies, including 5/24 and bonus eligibility rules, can change without notice. Also, Chase offers change frequently, so readers should verify the current terms before applying.

You Can Have Multiple Freedom Cards: Even if you already have a freedom card, you can still do this method and product change into another freedom card. You can hold several freedom cards by product changing into them, just not by applying directly for them. If you have a Freedom Flex card already but want to product change your Sapphire card into a Freedom Unlimited, you can do that. Or, lets say that you maximize the category bonuses each month up to the $1500 limit and want another Freedom Flex card so that you can earn another 7500 Ultimate Rewards points each quarter (5x points on $1500 spend), then you can product change your Sapphire card into a Freedom Flex card, and thus hold two of them. Just be aware that if you product change into one of the Freedom cards, then you won’t be able to do a new application for that same Freedom card down the road while you currently hold the product.

The Sapphire Downgrade strategy requires careful timing and understanding of the rules, but it's a common way for long-term Chase users to maximize Sapphire welcome offers over time.

This is an excellent time to complete a Sapphire downgrade right now due to the currently elevated Sapphire Preferred offer (If it has been at least 48 months since you last received the bonus). Click here to apply.

If you're unsure whether it's been 48 months since you last received the welcome bonus on your Sapphire Preferred, then you need a better organization method. When you get deep into this hobby and start adding several cards to your wallet, then you will quickly forget details about when you signed up for the card, received the bonus, etc. You can have access to my free Credit Card Organizer Spreadsheet to help you track the cards that you have opened so that you always know when you are eligible to churn them and get the bonus again.

Final Thoughts

Both the Chase Freedom Flex and Chase Freedom Unlimited are exceptional no-annual-fee credit cards packed with benefits, from valuable rewards and intro APR offers to travel and purchase protections. While strong on their own, they become significantly more powerful when paired with a Chase Sapphire Preferred or Reserve, transforming their cash back into highly valuable travel points. Although the Sapphire Preferred and Reserve always seem to get the hype in the travel world, the Freedom cards work well as work-horses to generate points on everyday spend by maximizing bonus categories and taking advantage of their higher earning potential.

Choosing between them depends on whether you value the high earning potential of rotating categories of the Freedom Flex, or the simple, consistent earnings of the Freedom Unlimited. Analyze your spending, consider the perks most valuable to you, and pick the Freedom card(s) that will best accelerate your journey to your next reward!

If this guide helped, consider using my referral links to support the blog—at no extra cost to you!”