The Ultimate 2025 Guide to the Capital One Venture X: Rewards, Benefits, Lounges & Transfer Partners

Capital One Venture X Review 2025: Is It Still the Best Travel Credit Card for Points Lovers?

If you’ve been travel hacking for a while—or you’re just starting to dip your toes into the points and miles world—you’ve probably heard the buzz around the Capital One Venture X. It launched as the “premium” card in Capital One’s lineup, promising big travel perks, airport lounge access, and a flexible rewards program for a (relatively) modest annual fee.

But does it still hold up in 2025? And is it worth the spot in your wallet over top-tier competitors like the Chase Sapphire Reserve or Amex Platinum?

Let’s break it down with an in-depth analysis, real-world examples, and practical strategies.

What Is the Capital One Venture X?

In plain English: the Venture X is Capital One’s premium travel rewards card. It earns flexible miles, comes with an annual travel credit, gets you into airport lounges, and opens the door to some serious points transfers for dream trips.

Here are the basics (and a few not-so-basic perks):

Current Welcome Bonus (2025): Earn 75,000 Capital One Miles after spending $4,000 in the first 3 months (this can change, so check the latest offer here. This initial haul of miles can be a fantastic springboard for your travel aspirations, potentially covering a significant portion of a premium flight or several nights in a comfortable hotel.

Earning Rates:

2x miles on every purchase: This consistent earning rate ensures that every dollar you spend contributes to your travel rewards balance, simplifying the process of accumulating miles without having to track bonus categories. You don’t have to worry about bonus categories, because each dollar spent earns 2 points no matter what.

5x on flights and vacation rentals and 10x on hotels/rental cars booked through Capital One Travel: This offers an accelerated earning opportunity when you utilize Capital One's own booking portal, which can be particularly lucrative for larger travel expenses.

Card Benefits:

An annual $300 travel credit for bookings through Capital One Travel portal.

$120 Global Entry or TSA Precheck credit

Priority pass membership

Access to Capital One Lounges

No foreign transaction fees

Annual 10,000 bonus miles at card renewal

Annual Fee: $395

How Do Capital One Miles Work?

Capital One Miles are a flexible travel currency—meaning you’re not tied to one airline or hotel chain. You can either:

Book travel directly through the Capital One Travel portal (more on that soon), or

Transfer your miles to a long list of airline and hotel partners—this is where the real travel hacking value comes in, allowing you to leverage the specific award charts and sweet spots of various loyalty programs.

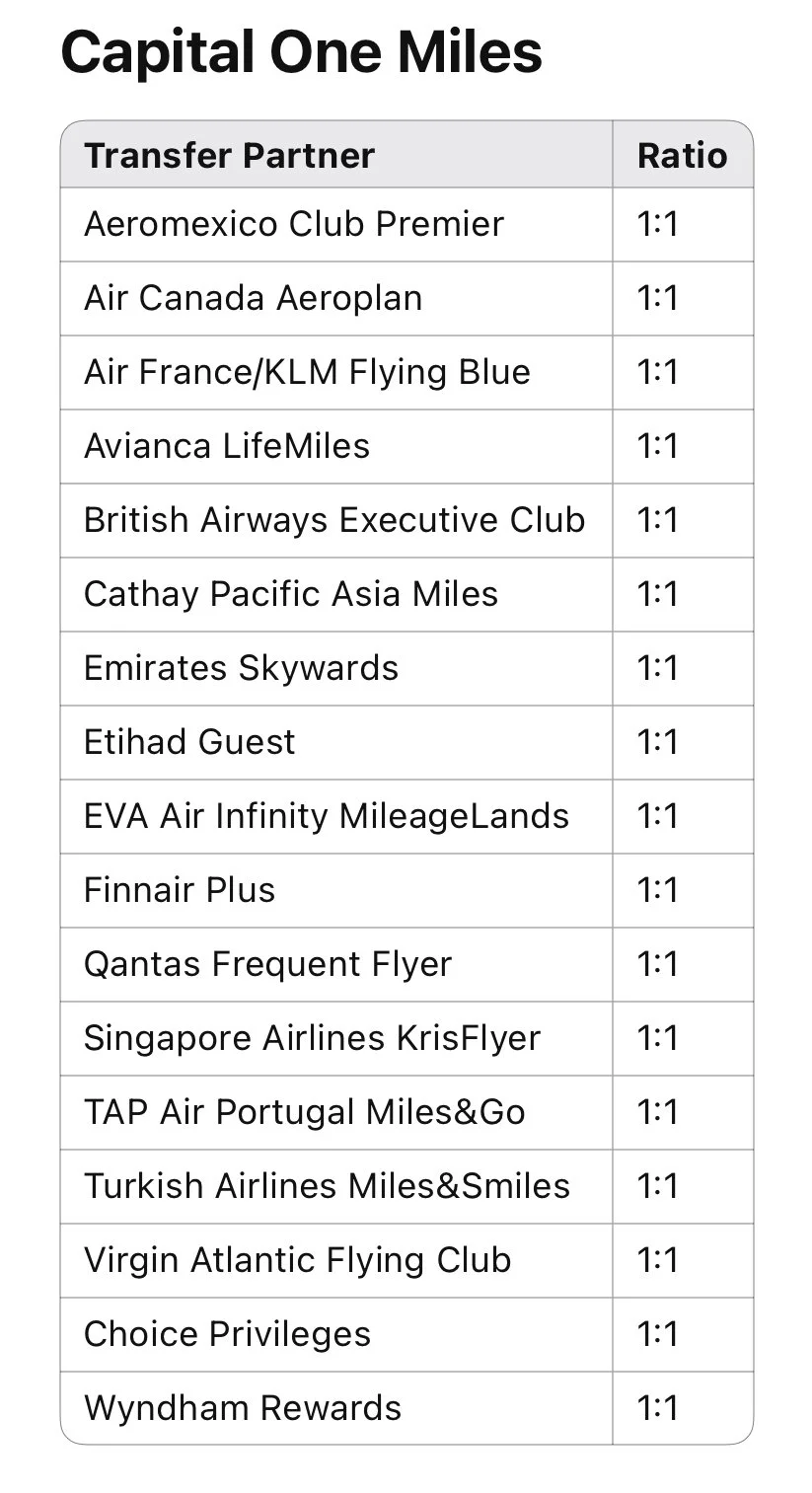

Most partners transfer at a 1:1 ratio, but a few are different. Understanding these transfer ratios and the nuances of each partner program is key to maximizing your redemptions.

Capital One Transfer Partners (2025)

Here’s your cheat sheet for all current transfer partners and ratios:

Real-World Redemption Examples

Let’s talk numbers. Because it’s not just about how many miles you earn—it’s about what you can do with them.

Here are some great redemptions that you can make with your capital one miles:

Business Class to Europe with Air France/KLM Flying Blue

Miles needed: ~55,000–70,000 miles one-way

Cash value: $2,000+

Transfer partner: Flying Blue (1:1)

Why it’s great: Flying Blue frequently offers monthly promo awards with significant discounts on business class flights between the U.S. and Europe. By transferring your Capital One miles, you can access these premium cabin experiences for a fraction of the cash price. Keep an eye on the Flying Blue promo rewards page for the latest deals!

Hawaii with Turkish Airlines Miles&Smiles

Miles needed: 15,000 round-trip in economy (yes, ROUND-TRIP)

Cash value: $500+

Transfer partner: Turkish Airlines (1:1)

The catch (worth it though!): Turkish Airlines has one of the most incredible sweet spots for flights to Hawaii. While their booking engine can sometimes be a bit quirky, the savings are immense. This is a prime example of how understanding niche transfer partner award charts can unlock incredible value.

Luxury All-Inclusive Hotels with Wyndham

Miles needed: 15,000–30,000 per night

Cash value: $400+ per night

Transfer partner: Wyndham Rewards (1:1)

Beyond the basics: Wyndham's partnership with Vacasa vacation rentals offers a unique way to redeem points. Each bedroom in a Vacasa property costs a fixed number of points per night. Imagine booking a 1-bedroom oceanfront rental in Hawaii or a cozy cabin in the mountains for the same points as a standard hotel room, often offering much more space and amenities.

Domestic Flights with British Airways Avios

Miles needed: As low as 6,000–9,000 Avios one-way for short-haul flights

Cash value: $150+

Transfer partner: British Airways Executive Club (1:1)

Perfect for quick trips: British Airways' distance-based award chart can be incredibly valuable for short, direct flights within North America on American Airlines. This can be a fantastic way to save on those weekend getaways.

Premium Economy on Long-Haul Flights with Virgin Atlantic Flying Club

Miles needed: Varies by route, but often significantly less than business class

Cash value: $1,000+

Transfer partner: Virgin Atlantic Flying Club (1:1)

A comfortable compromise: If business class redemptions are out of reach, Virgin Atlantic's premium economy product offers a significant upgrade in comfort on long-haul flights, and transferring Capital One miles can make it more attainable. Keep an eye out for transfer bonuses to Virgin Atlantic for even better value.

Capital One Travel Portal: Underrated Gem?

While most travel hackers focus on transfer partners (with good reason, as seen in those sweet redemption examples!), the Capital One Travel portal isn’t just a basic booking engine.

Here’s why it deserves a second look:

Price prediction tools (powered by Hopper) to help you time bookings: This feature analyzes historical and real-time pricing data to suggest the best time to book flights, potentially saving you money.

Price drop protection for flights—get refunded the difference if the price drops after booking: If you book a flight through the portal and the price drops within a certain timeframe, you may be eligible for an automatic refund of the difference.

Auto-refund on hotel cancellations (if eligible): The portal can streamline the often-tedious process of hotel cancellations and refunds, provided your booking is eligible.

Earn bonus miles: up to 10x on portal bookings: Booking flights, hotels, and rental cars through the portal can earn you significantly more miles than the standard 2x, especially during promotional periods.

Price match guarantee: If you find a better price for the same flight, hotel, or rental car on another website within 24 hours of booking through Capital One Travel, you may be eligible for a credit for the difference.

I’ve actually used this before and it’s legit. I booked a hotel in Venice through the portal because I wanted to use up my $300 travel credit that was expiring. The hotel through the portal was about $180 more than booking directly. After booking, I immediately called Capital One’s customer service. They were able to look up and see the price discrepancy, and they credited $180 back to my account in the form of Capital One travel credit to be used on future bookings.

Plus, remember: your $300 annual travel credit must be used through the portal. So even if you’re normally a transfer-partner purist, it’s worth finding a decent use there once a year to offset the annual fee. Consider using it for a hotel stay during a quick weekend trip or a rental car for a local adventure. If you are not concerned about getting elite night credits or elite benefits at a hotel, then that might be a great way to spend your credit. This year, I am spending my credit at a hotel in Greenland as there were no chain hotels that I could transfer points to due to Greenland being such as remote location. (More posts about this trip, and how I used points and travel credits to offset the high costs, will be coming soon!)

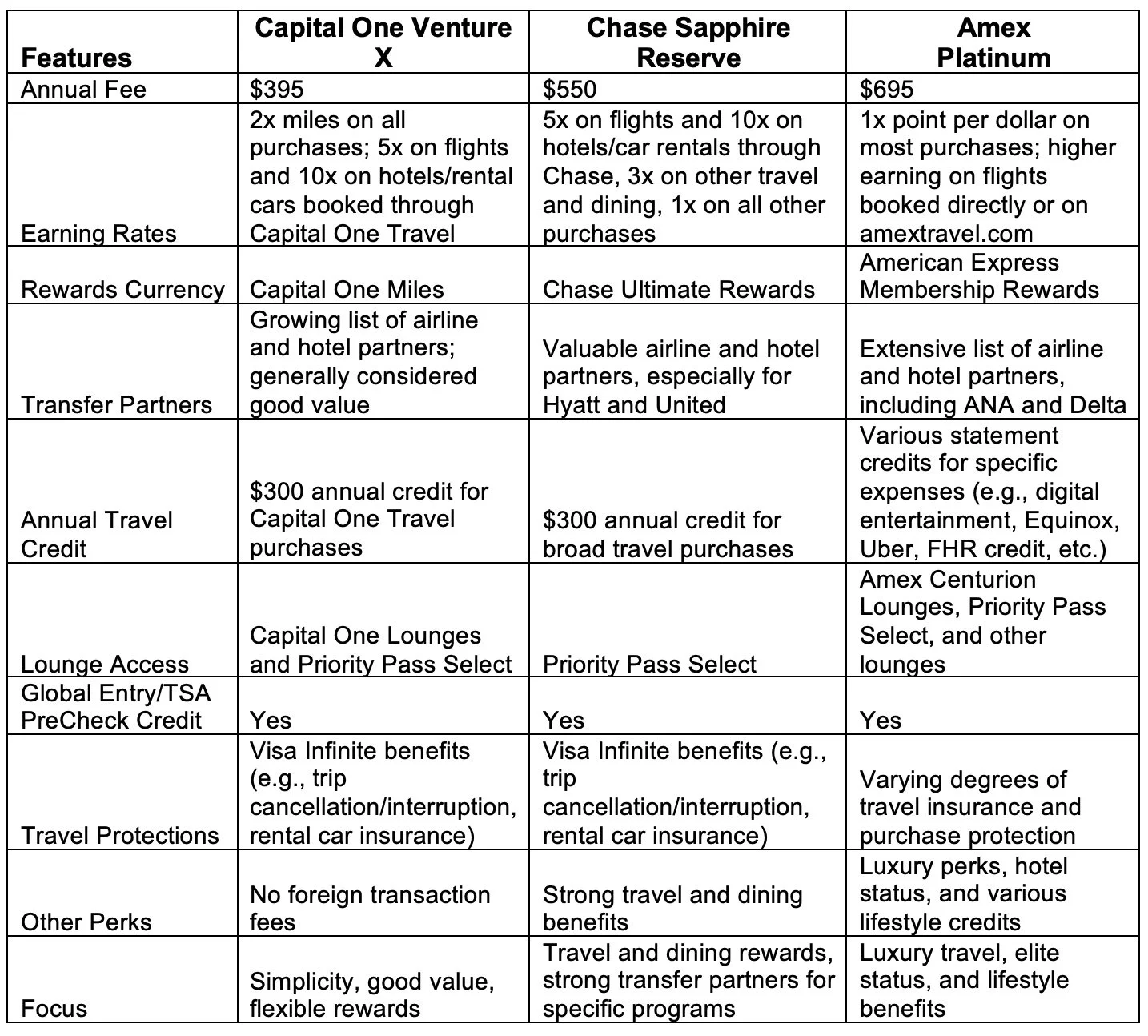

Venture X vs. Chase Sapphire Reserve vs. Amex Platinum

Let’s size up the competition.

My take: If you’re all about maxing luxury perks (like Centurion lounges or elite hotel status) and are deeply embedded in the Amex ecosystem, the Amex Plat might still edge ahead. If you have strong loyalty to Hyatt or United and value their specific transfer options, the Chase Sapphire Reserve could be a better fit. However, for most people who want a fantastic balance of easy earnings, excellent lounge access (including Capital One's growing network), a valuable travel credit that's relatively easy to use, and a growing list of valuable transfer partners without the highest annual fee, the Venture X hits the sweet spot. It's particularly appealing for those who appreciate a more straightforward approach to travel rewards. Because the Venture X offers $300 annual travel credit and 10,000 annual bonus points, I consider this card a $0 annual fee card. I also have a Capital One lounge at my home airport and we frequent it every time we travel, so I consider this card to be a keeper.

Strategies to Maximize Capital One Rewards with Venture X in 2025

Let’s make those miles work overtime:

Pair it with SavorOne: The Capital One SavorOne card offers 3x miles on dining, entertainment, popular streaming services, and at grocery stores (excluding superstores like Walmart and Target) with 1 no annual fee. You can then seamlessly transfer these miles to your Venture X account, effectively boosting your earning power in these everyday spending categories.

Wait for transfer bonuses: Capital One frequently runs limited-time transfer bonuses to select airline and hotel partners (e.g., a 20% bonus when transferring to Virgin Atlantic or Flying Blue). Keep a close eye on these promotions, as they can significantly increase the value of your redemptions.

Use it abroad: With no foreign transaction fees, the Venture X is your best friend when traveling internationally. Every purchase earns you valuable miles without any extra charges.

Book refundable flights with travel portal: Utilize the price prediction and price drop protection features of the Capital One Travel portal when booking refundable flights, offering both potential savings and flexibility.

Refer friends: Capital One often offers referral bonuses (e.g., 20,000 miles per approved referral). Share your referral link with friends and family to earn even more miles.

Capital One offers: Capital One Offers is a program that provides targeted offers to Capital One cardholders. You can find these offers by logging into your Capital One account online or through the mobile app. These offers can be for various retailers, and you can earn either cash back or Capital One Miles by activating the offer and then making a purchase with your Capital One card.

Add authorized users: Venture X authorized users are free. You can use this to your advantage to bring more family members or friends into the airport lounges with you. Each authorized user will receive their own priority pass membership and also be allowed into Capital One lounges. You can pair this with the primary cardholder’s priority pass, and this will allow 2 players to bring in their entire family of 6 due to each cardholder being allowed entry along with 2 guests. One annual fee can yet a family of 6 into the lounge, great deal!

What’s Next for Capital One in 2025?

The buzz in the points and miles world suggests some exciting developments for Capital One in 2025:

Expansion of the Capital One Lounge Network: More Capital One Lounges are slated to open in key airports, including Denver (DEN), Las Vegas (LAS), and Seattle-Tacoma (SEA), by late 2025. This will significantly enhance the lounge access benefits for Venture X cardholders traveling through these hubs.

Potential New Transfer Partners and Enhanced Elite Status Opportunities: There are strong rumors circulating about the addition of new hotel transfer partners (with Hyatt being a frequently mentioned possibility) and potential pathways to earn or enhance elite status within partner programs through Capital One.

Smarter Booking Options in the Travel Portal: Capital One is reportedly beta-testing more dynamic booking options within their travel portal, potentially mirroring Chase's "Pay with Points" flexibility but with more intelligent recommendations and integration of their price prediction data.

These potential developments indicate that Capital One is serious about investing in its premium travel offerings and making the Venture X an even more compelling long-term contender in the competitive travel rewards landscape.

Final Verdict: Is Venture X Still Worth It?

If you value simplicity, flexibility, and substantial value without the burden of an ultra-high annual fee, the Capital One Venture X continues to be one of the best travel credit cards on the market in 2025. I personally feel that the Venture X is definitely well worth getting for the sign up bonus as well as potentially keeping long term.

It’s particularly perfect for:

Individuals and couples who travel several times a year and can readily utilize the travel credit and lounge access.

Families who appreciate straightforward rewards without the need to micromanage spending categories.

Families who need to get several people into a lounge. The priority pass comes with 2 free guests. If you add your spouse as an authorized user, then he or she is able to get their own priority pass membership for free! That means that you can get 6 people into the lounge with one annual fee.

Anyone in the Capital One lounge footprint. The lounges are excellent. Food and drinks are great. They even have diapers, bibs, wipe warmer fully stalked, etc in a dedicated nursing/changing room.

Anyone seeking premium travel perks and excellent transfer partner options without the premium headaches and high annual fees of some competitors.

With its growing list of valuable transfer partners and ongoing investments in its travel ecosystem, the Capital One Venture X is not just a solid card for 2025—it’s becoming a serious and increasingly attractive player in the points and miles game for savvy travel hackers.

Ready to apply? Click HERE to start your application.